is colorado a non community property state

Our Website uses automatic data collection technologies to obtain the Non. Here in Colorado we are blessed with very low property taxes compared to many other states.

The median-value home in Colorado has a property tax bill of just over 2000 per year whereas the median-value home in New.

. Colorado is also a dual-property state which means property can. If you and your spouse have credit cards car loans mortgage loans or other types of debt then community property laws hold you both equally liable for them. Most of the time property purchased in a community property state using funds that were earned in a state that is not a community property state is excluded from the assets to be split 5050.

Arizona california idaho louisiana nevada new mexico texas washington. But there may be certain exceptions to this rule. As of 2020 there are nine states where community property laws are observed.

The withholding tax when imposed is the lesser of two percent of the sales price rounded to the nearest dollar or the net proceeds from the sale. 1-800-850-0607 303-273-2923. However Colorado is not a community property state.

Instead Colorado judges are tasked with dividing the property in a fair and impartial manner considering the facts and circumstances of the case to determine what is fair or equitable and not necessarily equally. Yes- Both husband and wife must execute deed of trust which is to encumber property of the community. This can be done using the phrase as joint tenants with right of survivorship or in joint.

However non-owner spouse should execute a disclaimer of interest in the property Quitclaim Deed Interspousal. In non-community property states on the other hand the assets of the debtor spouse are separate from the other spouse unless both spouses are indebted to the same creditor. Colorado 2 Withholding on Real Estate transactions.

Which States Use Community Property Laws. Instead of dividing property 5050 in a divorce case the Colorado courts will divide marital property assets and debts in a way that is equitable or fair based on the factors of the unique case. 303-894-2166 Toll Free.

In equitable distribution states more assets may be considered marital property but the split is not necessarily 50-50. This includes vehicles homes furniture appliances and luxury items. 303-894-2683 Share Website Feedback.

In the United States there are ten community property states. Community property states classify the following as a married couples joint property. Colorado is an equitable distribution divorce state.

Colorado is an equitable distribution state which means property will be divided by the court in a manner that is deemed fair to both parties but not necessarily equal if spouses cannot come to a resolution on their own. For example if you are applying for a government loan insured by the Federal Housing Administration FHA or the Veterans Affairs VA your spouses credit will need. Community property law is a form of property ownership which dates back to the year 693 in Visigothic Spain.

Instead when a couple divorces in Colorado the marital property is divided in an. The general rule is that community property is divided 5050. This is in contrast to some other states where the property is held as community property Under Colorado law.

Other community property states recognize these forms of ownership and will treat the asset as separate property of the spouses held in joint tenancy. Courts have much more leeway to determine how property is divided in equitable distribution states The majority of community property states wont deviate from the 5050 division regardless of the circumstances. Therefore your spouses debts may negatively affect your mortgage application.

Any real or personal property acquired with income earned during the marriage. They go as follows. However Colorado is not a community property state.

Colorado imposes a withholding requirement on corporations that do not maintain a permanent place of business in Colorado and non-resident individuals estates and trusts on the sale of real estate in excess of 100000. Colorado is not a community property state in a divorce. Any income received by either spouse during the marriage.

Colorado is not a community property state in a divorce. It uses a common law doctrine rather than one based on the laws of community property. Any debts acquired during the marriage.

That means marital property isnt automatically assumed to be owned by both parties and therefore should be divided equally upon divorce. The HOA Information and Resource Center The HOA Office A program of the Division of Real Estate. A Colorado property division order is a court order issued by a court order issued by a judge describing how property is to be divided between spouses following a divorce.

A summary of each of the community property states treatment of property purportedly titled in joint tenancy or tenancy in common is shown in Exhibit 25181-1. According to USA Today Colorado has the 7th lowest property tax rates in the country although that is a statewide average. Joint tenancy can only be created if expressly stated in the deed.

Wwwsummitcountycogov Instead of dividing property 5050 in a divorce case the colorado courts will divide marital property assets and debts in a way that is equitable or fair based on the factors of the unique case. To create a co-ownership in joint tenancy the instrument conveying the property must state that the property is conveyed to the grantees in joint tenancy or as joint tenants. Colorado is an equitable distribution or common law state rather than a community property state.

In our Summit County real estate market where many of our buyers and sellers are not residents of the state of Colorado this comes up quite a lot. If record title to real property is held as a spouses sole and separate property signature of non-owner spouse is not required. The rules vary greatly on this.

The same rule goes for debt. Colorado state law requires an equitable division of marital property. Email HOA questions to the HOA Office dora_dre_hoainquiriesstatecous 1560 Broadway Suite 925 Denver CO 80202 Phone.

Is Colorado A Non Community Property State - Colorado is not a community property state but it does have a category called marital property in colorado most assets acquired during a marriage are considered marital property which is subject to division by the courts in a divorce. In Community Property States all liabilities are considered 50 responsibility of both spouses. Such assets are termed community property.

A property division order is a binding legal obligation and failure to comply with the terms in full by either spouse can result in being charged with contempt of court. Alaska Arizona California Idaho Louisiana Nevada New Mexico Texas Washington and Wisconsin. If you are a non-Colorado resident and you sell your Colorado property the title company may be required to withhold a portion of your proceeds for state income tax.

The main difference between community property and equitable distribution is that in community property states there is an absolute 50-50 split of all property acquired during the marriage.

State Corporate Income Tax Rates And Brackets Tax Foundation

Colorado Inheritance Laws What You Should Know Smartasset

Pin On Colorado S National State Register Listings

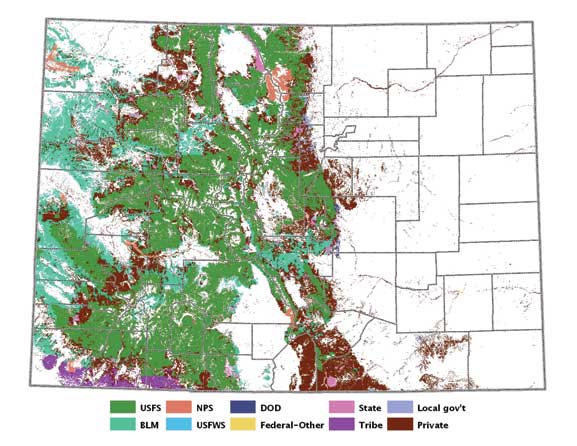

Colorado Land Ownership Colorado State Forest Service

Epa Knew Of Blowout Risk For Tainted Water At Gold Mine Epoch Times Newspaper Editorialdesign Epoch Epoch Time Water

Community Property States List Vs Common Law Taxes Definition

![]()

Divorce In No Fault States South Denver Law

Stonework And Hardscapes Backyard Landscaping Outdoor Gardens Colorado Landscaping

Division Of The Marital Estate Colorado Family Law Guide

What Is Title Insurance Realestate Realestateagent Realestatebroker Realtor Listing Realestatelisting Listingpresentati Title Insurance Title Insurance

Community Property States List Vs Common Law Taxes Definition

Printable Sample Last Will And Testament Form Will And Testament Last Will And Testament Free Basic Templates

How Is Property Divided In A Colorado Divorce

Is Colorado A Community Property State Cordell Cordell

Plat Map Of 0 Soul Shine Road Drake Colorado Plat Visitestespark Land Turnkeyrealty Margaretherdt Sale Realestate Soul Shine Estes Park Map

The Mount Muscoco Trailhead Is The Same As Mount Cutler Trailhead And The Trails Are The Same For About A Half Mile Until They Colorado Travel Best Hikes Trail

Community Property States List Vs Common Law Taxes Definition